The issues associated with climate change and carbon neutrality pose significant challenges to the economic and financial systems. As climate change risks do not unidirectionally affect firms, it is important to understand how firms and managers perceive climate change effects, according to a recent study on the awareness of climate change and the influences of financial market conditions.

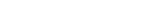

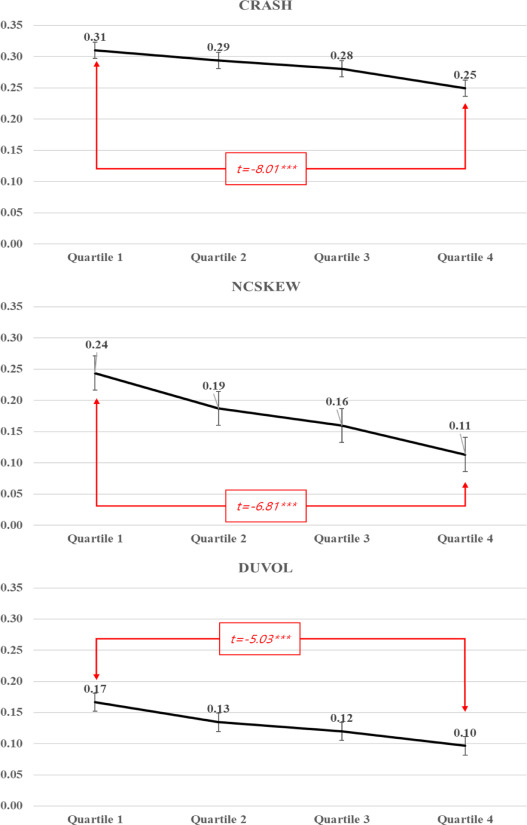

A research team, led by Professor Chang-Keun Song in the Graduate School of Carbon Neutral has examined the effects of managerial perspectives on climate change on stock price crash risk. Their study shows that firm-level climate change perspective may have a positive effect on reducing a firm’s crash risk likelihood.

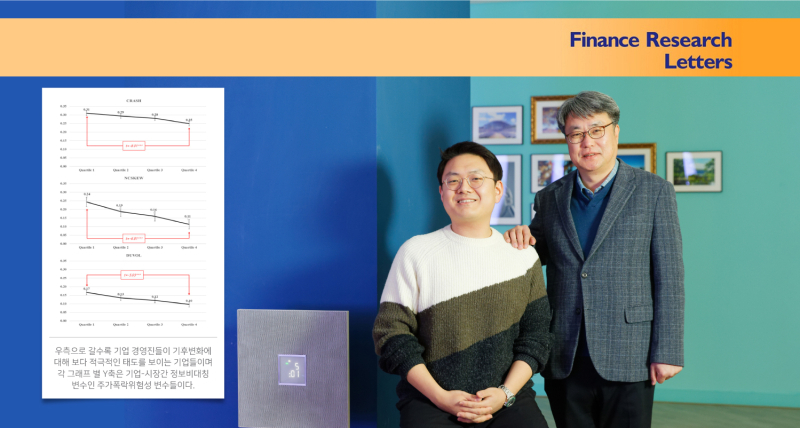

Figure 1. Change of crash risk measures with respect to climate change perspective level.

In this study, the research team conducted various channel tests to understand the underlying mechanism between climate change perspective and crash risk. They construct firm-level time-varying climate change perspective measures using machine learning methods.

Using climate change perspective calculated from earnings call transcripts, the research team suggested that a higher perspective of global climate change issues attracts the attention of external parties, such as investors and financial analysts, whose monitoring reduces a firm’s negative information withholding behavior.

“Our study provides strong evidence supporting signaling theory and offer practical contributions for a firm’s sustainable development,” noted the research team.

Their findings have been published in the January 2023 issue of Finance Research Letters, a peer-reviewed academic journal covering research on all areas of finance.

Journal Reference

Hail Jung and Chang-Keun Song, “Managerial perspectives on climate change and stock price crash risk,” Finance Res. Lett., (2023).